Within the United States, NeweggBusiness.com charges tax on orders shipping to a number of states where NeweggBusiness is required to collect tax. If you are a tax-exempt organization or reseller, you can apply for tax exemption on your NeweggBusiness.com orders within your account or during checkout.

- If you are a federal government entity using a federal agency GSA card, there’s no need to apply for tax exemption. Check out, and your order will be tax exempt.

Applying For Tax Exemption

Be sure to create a NeweggBusiness.com account if you do not have one.

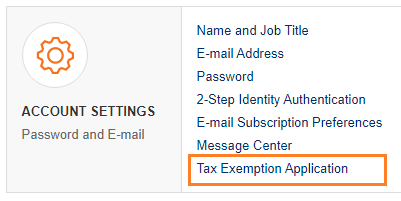

1. During checkout select Apply for Tax Exemption or navigate to your Account and select Tax Exemption Application found under Account Settings.

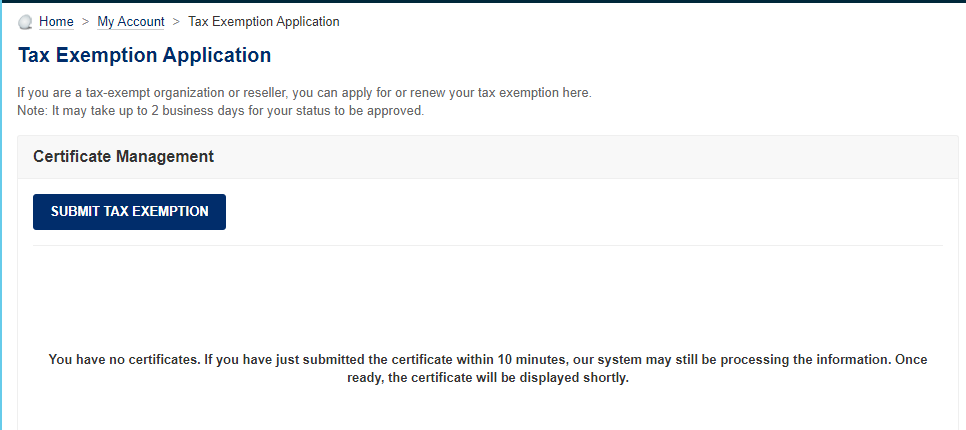

2. Click on the Submit Tax Exemption button to apply. You will also see a list of any previous certificates you have submitted.

3. When uploading your tax certificate, please make sure the following information is included on it:

- Business/Organization Name (Individuals name is not accepted)

- State Issued Exemption Number and/or FEIN# (if applicable)

- Certificate must be dated in the current year

- Seller’s Name and Address

- Newegg Business Inc.

21688 Gateway Center Dr. Suite 300 Diamond Bar, CA 91765

- Newegg Business Inc.

- Description of Item(s) that will be purchased with NeweggBusiness

(Example: IT hardware, software, and other computer peripherals.

NOTE: If you are a Charitable, Educational, Religious, State, or Federal government entity based out of US territory please refer to your respective states Sale and Use Tax official website for additional Documentation requirements.

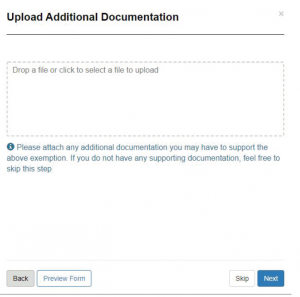

- Please upload any additional documentation such as funds verification documentation for Charitable, Educational, Religious, State, or Federal government entities when you see this page during the Tax Exemption upload process.

Can a sub-account apply?

The Tax Exemption Application portal can only be accessed by a Primary User on the account. Please contact the Primary User to proceed with tax exemption requests. For further assistance please contact us at taxexempt@newegg.com.

Processing Timeframe

All submitted tax exemption certificates take 2 business days to process. Once your application is processed, future orders will no longer be taxed by NeweggBusiness.com.

A valid resale permit & reseller certificate must be in place during purchase to qualify for sales tax exemption.

- What is a valid resale permit? valid resale permit number, date, and company name verified against state government data base.

- What is a valid resale certificate? date, description of property being purchased for reseller, and signed reseller certificate.

Having Issues?

If your having issues, please send us an email along with your issue and information to: taxexempt@newegg.com